The Best Investment Properties to Buy Right Now

The current state of the market demands that potential investors stay abreast of the best opportunities available. Various factors, including economic trends and demographic changes, influence the real estate market. Understanding these dynamics is key to making strategic decisions about investment properties.

Key Takeaways

- Economic trends and demographic changes significantly impact the real estate market.

- Understanding the various types of investment properties can lead to more strategic decisions.

- Potential investors should consider the potential return on investment.

The Best Investment Properties to Buy Right Now: Market Analysis

The quest for the best investment properties to buy right now requires a deep dive into the current market trends and analysis. Understanding the dynamics of the real estate market is crucial for investors to make informed decisions.

Single-Family Homes in Growing Suburbs

Single-family homes in growing suburbs offer a stable source of rental income. These areas are typically characterized by their proximity to good schools, public transportation, and amenities. Investors can benefit from the steady demand for housing in these suburbs.

Multi-Family Properties in Urban Centers

Multi-family properties in urban centers provide a higher return on investment due to their proximity to employment and entertainment hubs. These properties can command higher rents, but they also come with higher management costs and potential vacancies.

Short-Term Rental Properties

Short-term rental properties can capitalize on the tourism industry, offering potentially higher returns than traditional long-term rentals. However, they require more active management, including frequent guest turnover and compliance with local regulations.

Commercial Real Estate Opportunities

Commercial real estate opportunities, such as office buildings and retail spaces, can offer long-term leases and potentially higher returns. These investments come with higher risks and require significant upfront capital, but they can provide a steady income stream.

Steps to Identify and Purchase Profitable Investment Properties

This involves several key steps that help investors make informed decisions and avoid potential pitfalls.

Research Local Market Conditions

Understanding local market conditions is the foundation of successful real estate investment. This includes analyzing demographic trends, employment rates, and local economic indicators to determine the growth potential. For instance, areas with growing populations and job markets tend to have higher demand for housing, making them ideal for investment.

Key factors to research:

- Demographic trends

- Employment rates

- Local economic indicators

- Housing demand

Calculate ROI and Cap Rates

Calculating the Return on Investment (ROI) and capitalization rate (cap rate) is crucial for understanding the financial viability of a property. ROI measures the return on investment relative to its cost, while the cap rate measures the ratio of net operating income to the property’s value.

| Metric | Description | Formula |

|---|---|---|

| ROI | Return on Investment | |

| Cap Rate | Capitalization Rate | Net Operating Income / Property Value |

Secure Appropriate Financing

Securing the right financing is critical for real estate investment. Investors should explore various financing options, including traditional mortgages, private money lenders, and partnerships.

Financing options to consider:

- Traditional mortgages

- Private money lenders

- Partnerships

- Hard money loans

Conduct Thorough Property Inspections

Conducting thorough property inspections is essential to identifying potential issues before they become major problems. This includes evaluating the property’s condition, checking for any needed repairs, and assessing its overall value.

Build a Property Management Strategy

A well-planned property management strategy is crucial for maintaining the property and ensuring it remains a profitable investment. This includes hiring a property management company, handling tenant relations, and overseeing maintenance and repairs.

Key components of a property management strategy:

- Hiring a property management company

- Handling tenant relations

- Overseeing maintenance and repairs

- Managing property finances

Conclusion

Investing in the best investment properties requires a thorough understanding of the market and a well-planned strategy. By analyzing local market conditions, calculating ROI and cap rates, securing appropriate financing, conducting thorough property inspections, and building a property management strategy, investors can make informed decisions that align with their financial goals.

The right investment properties can provide a steady stream of income and long-term appreciation in value. Whether it’s single-family homes in growing suburbs, multi-family properties in urban centers, short-term rental properties, or commercial real estate opportunities, each type of investment property has its unique benefits and challenges.

By carefully evaluating these factors and staying focused on their investment objectives, investors can navigate the complex world of real estate investment and achieve success with their investment properties.

FAQ

What are the key factors to consider when buying investment properties?

When buying investment properties, it’s essential to consider factors such as location, local market conditions, potential for rental income, and the overall state of the real estate market. Additionally, understanding economic trends, demographic changes, and the type of property you’re investing in, such as single-family homes or commercial real estate, can help you make informed decisions.

How do I research local market conditions for investment properties?

Researching local market conditions involves analyzing demographic trends, employment rates, and local economic indicators to determine the growth potential. You can also review data on local property sales, rental rates, and vacancy rates to gain a better understanding of the market.

What is the difference between ROI and cap rate in investment properties?

ROI (Return on Investment) measures the total return on investment, including both rental income and appreciation, while cap rate (capitalization rate) measures the return on investment based on the property’s net operating income. Understanding both metrics can help you evaluate the financial viability of an investment property.

What financing options are available for investment properties?

Financing options for investment properties include traditional mortgages, private money lenders, hard money loans, and partnerships. The best option for you will depend on your financial situation, investment goals, and the type of property you’re purchasing.

Why is property inspection important when buying investment properties?

Conducting thorough property inspections is crucial to identifying potential issues before they become major problems. This can help you avoid costly surprises down the road and ensure that your investment property remains a profitable venture.

How do I build a property management strategy for my investment properties?

Building a property management strategy involves determining whether to self-manage or hire a professional property management company, setting rental rates, and developing a plan for maintenance and repairs. You should also consider strategies for minimizing vacancies and maximizing rental income.

What are the benefits of investing in single-family homes versus multi-family properties?

Single-family homes can offer a stable source of rental income, while multi-family properties can provide a higher return on investment due to their proximity to employment and entertainment hubs. The best choice for you will depend on your investment goals, local market conditions, and your management strategy.

How do short-term rental properties compare to long-term rentals?

Short-term rental properties can capitalize on the tourism industry, but they require more active management and may be subject to local regulations and seasonal fluctuations. Long-term rentals, on the other hand, can provide a more stable source of income, but may offer lower returns.

![Tune in to the Triple J Hottest 100 [Year] triple j hottest 100](https://shoptips24.com/wp-content/uploads/2025/07/triple-j-hottest-100-220x150.jpeg)

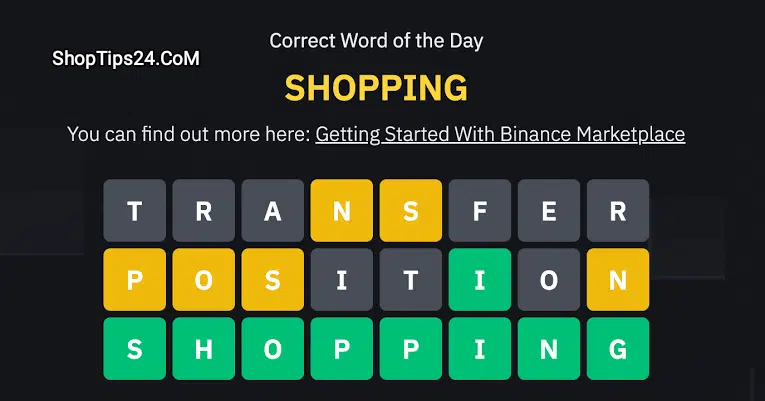

![Binance Wotd Words Answers Today [Solved] 15 July 2025 Binance Word of the Day](https://shoptips24.com/wp-content/uploads/2025/06/cadd173bbaa4a1a867fcdaa6c19535f80bf6b49baf9f2016c581a4271d0fd9fd.png)